It’s about time!!! If you are thinking of buying a car, you may want to wait until July 30, 2024.

In December 2023, after much lobbying by consumer advocate groups across the country, the Federal Trade Commission (“FTC”) announced the “Combating Auto Retail Scams Rule,” otherwise known as the “CARS Rule.”

The CARS Rule sets requirements which must be followed by car dealers when selling, financing, or leasing vehicles to consumers.

The final rule, which goes into effect on July 30, 2024, prohibits car dealers from making misrepresentations to car buyers during the purchase of a vehicle, specifically, in the dreaded financing process.

The CARS Rule sets forth new requirements for dealer advertising and sales communications, ie: internet, print, television. It requires dealerships to obtain a car buyer’s express consent for charges, and prohibits the sale of add-on items (services or products) if there is no benefit to the car buyer. These services and products include, but are not limited to, (1) Nitrogen for tires; (2) VIN etching; (3) Tow hitch; (4) Extended warranties; (5) Ceramic coating. These products can be purchased MUCH cheaper outside of the dealership.

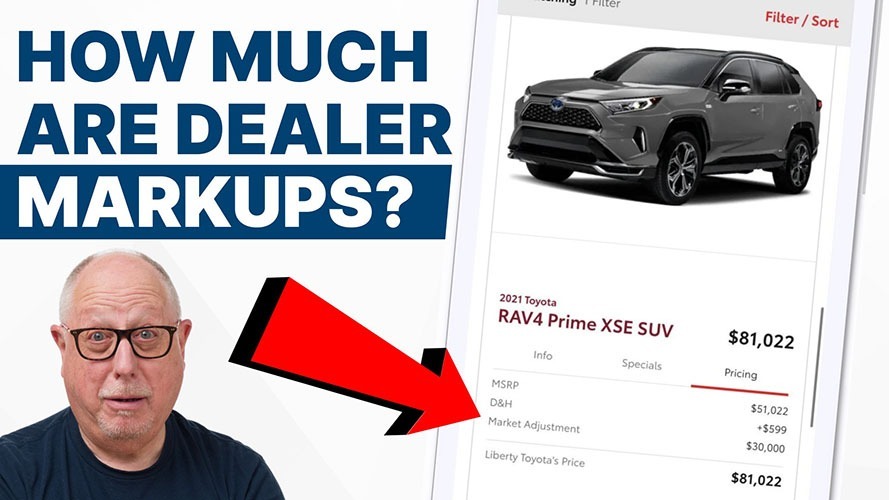

The FTC stated that the CARS Rule is intended to address deceptive and unfair practices in the motor vehicle marketplace, which includes bait-and-switch tactics and unlawful deceptive and unlawful practices related to add-on/aftermarket products which are huge moneymakers for car dealers. This is the bread and butter of the car dealer industry.

Requirements of the CARS Rule prohibits car dealers from making misrepresentations regarding any material information related to 16 categories of a car purchase. The term “material” means likely to affect a person’s choice or conduct regarding the purchase of goods or services.

The CARS Rule protects car buyers from auto retail scams:

1. The costs or terms of purchasing, financing, or leasing a vehicle.

2. Any costs limitation, benefit or other aspect of an add-on product or service.

3. Whether the terms are, or transaction is, for financing or leasing a vehicle.

4. The availability of any rebates or discounts that are factored into the advertised price of a vehicle but not available to all car buyers.

5. The availability of vehicles at an advertised price.

6. Whether any consumer has been or will be pre-approved or guaranteed for any product, service, or term.

7. Any information on or about a consumer’s application for financing.

8. When the transaction is final or binding on all parties.

9. Keeping cash down payments or trade-in vehicles, charging fees, or initiating a legal process if a sale is not finalized.

10. Whether or when a car dealer will pay off some or all of the loan/financing on a car buyer’s trade-in vehicle.

11. Whether consumer reviews or ratings are unbiased, independent, or ordinary consumers reviews.

12. Whether the car dealer or its personnel or products/services are affiliated with/endorsed by/associated with a government agency.

13. Whether consumers have won a prize of sweepstakes.

14. Whether a vehicle may be moved, including across State lines or out of the country.

15. Whether, and under what circumstances, a vehicle can be repossessed.

16. Any other required disclosures under the CARS Rule.

Hopefully, these much-needed reforms to the car buying process will benefit the millions of consumers who purchase cars every year.

Who is Allowed to sue Under the CLRA?

Who is Allowed to sue Under the CLRA?